![Financing-Your-First-Investment-Property[3]](https://access.ultrasavvyphotographer.com/wp-content/uploads/2017/04/Financing-Your-First-Investment-Property3.png)

LOVE IT OR HATE IT, TAX REFORM IS NOW LAW.

Love taxes? Didn’t think so, but it is best to be in the know with the new tax reforms of 2018 that will effect your real estate property.

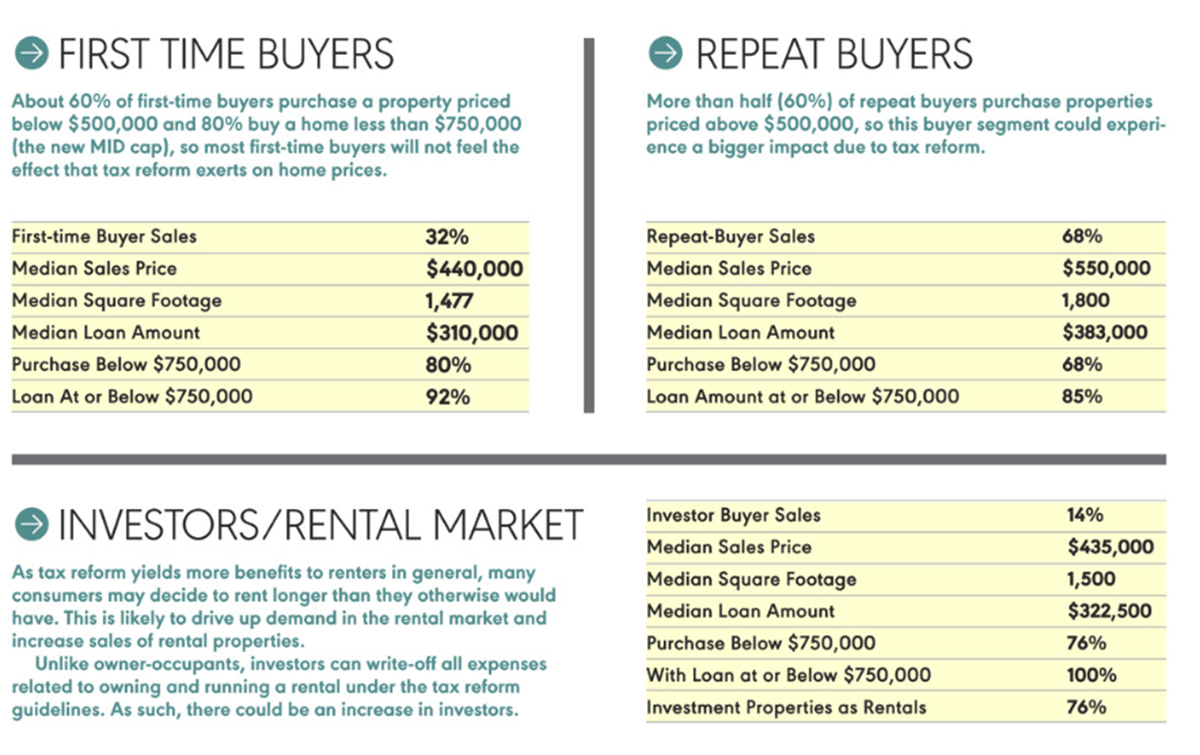

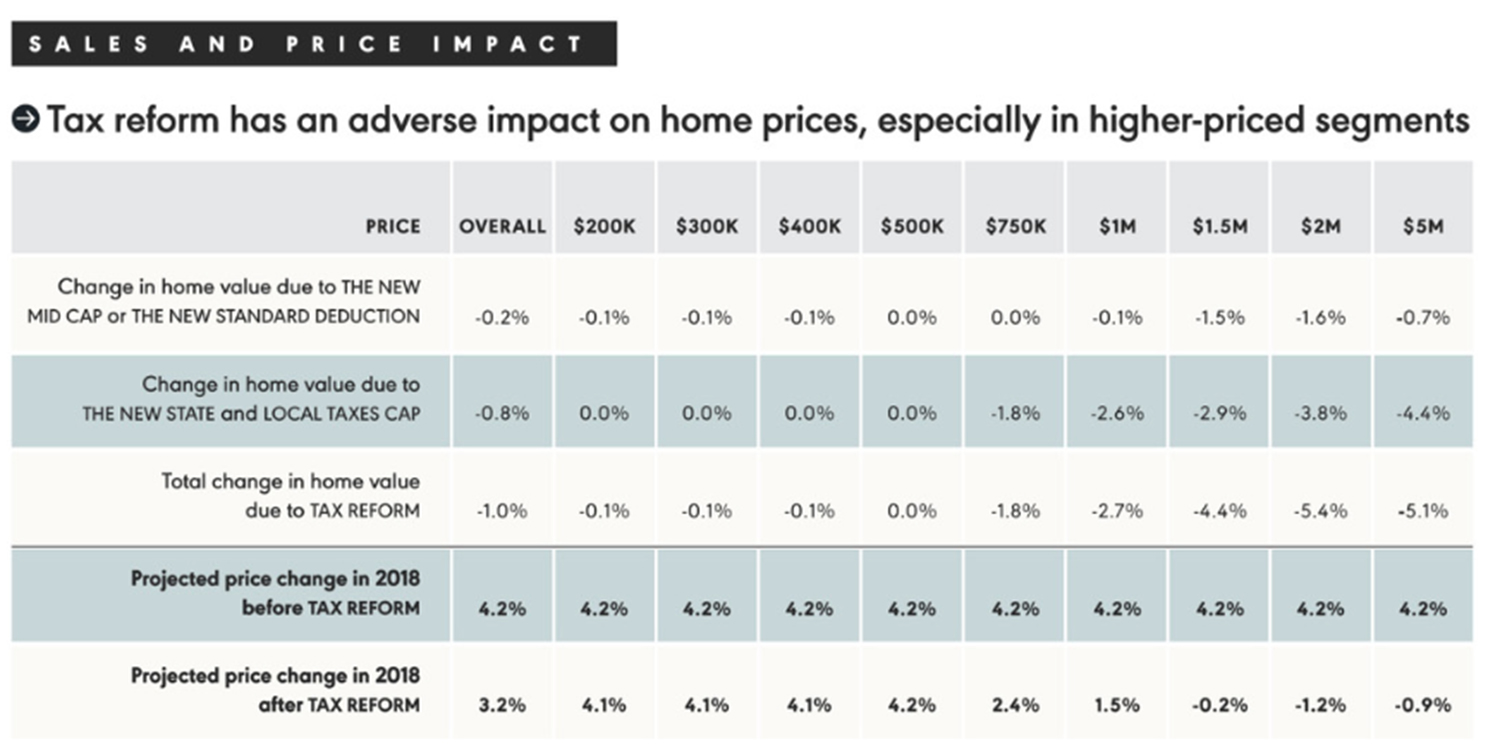

Mortgage interest deduction: As of January 1, 2018, the new cap for mortgage interest deductions is $750,000, down from $1 million.

The mortgage interest deduction for existing mortgages of up to $1 million secured before Dec. 15, 2017 will not be affected. Homeowners may also refinance mortgage debts existing as of Dec. 14, 2017 up to $ 1 million and still deduct the interest, so long as the new loan does not exceed the amount of the mortgage refinanced.

HOME EQUITY LOANS:

The interest paid on home equity loans is only deductible if the proceeds are used to substantially improve the residence.

STATE AND LOCAL PROPERTY TAXES:

California residents now have a $10,000 combined cap on all their state and local tax deductions, inclusive of real property taxes, state or local income taxes, and sales taxes. The $10,000 limit applies ot both single and married filers and is not indexed for inflation.

CASUALTY LOSSES:

The Tax Cuts and Jobs Act allows casualty losses to be deducted only in a presidentially declared disaster.

MOVE EXPENSES:

Moving expenses are deductible only for members of the Armed Forces.

TAX BRACKET CHANGES:

There will continue to be seven tax brackets, but the marginal tax rates in each bracket will be slightly lower.

STANDARD DEDUCTION:

The standard deduction will nearly double for 2018 to $12,000 for individuals and $24,000 for joint filers. Analysis shows that by doubling the standard deduction, Congress has greatly reduced the value of the mortgage interest and property tax deductions as tax incentives for homeownership. Congressional estimates indicate that only 5-8 percent of filers will now be eligible to claim these deductions by itemizing, meaning there will not be a tax differential between renting and owning for more than 90 percent of taxpayers. This consequence is felt more keenly in California than other parts of the country due to California’s higher overall tax rate and higher home prices.

PERSONAL EXEMPTIONS:

Personal exemptions for taxpayers and dependents have been repealed. Under prior law, tax filers could deduct $4,150 for the filer and his or her spouse, if any, and for each dependent, but they will no longer be able to do so.

QUALIFIED BUSINESS EXPENSES:

Real estate licensees, among other groups, may be able to deduct qualified business income. The provision allows an off the top (above the line) deduction of 20 percent business income, subject to certain provisions. There are income limitations of $157,500 for single taxpayers and $315,000 for joint filers. Above these income levels phase out provisions apply.

SECTION 179 EXPENSING:

The amount of qualified property eligible for immediate expensing increased from $500,000 to $1 million. The phase-out limitations are increased from $2 million to $2.5 million.

The definition of qualified real property eligible for section 179 expensing has been expanded to include any of the following improvements to nonresidential real property placed in service after the date such property was first placed in service: roofs, heating, ventilation, and air conditioning property; fire protection and alarm systems and security systems.

EXTERTAINMENT EXPENSES:

No deduction is allowed with respect to:

An activity generally considered to be entertainment, amusement or recreation

Membership dues with respect to any club organized for business, pleasure, recreation or other social purpose

A facility or portion of a facility used in connect with the above items

Taxpayers may still generally deduct 50 percent of the food and beverage expenses associated with operating their trade or business (e.g., meals consumed by employees on work travel).

RENTAL INCOME:

The 20-percent qualified business income deduction applies to rental income since the changes that produced the “wage and capital exception” were intended to apply to rental income. However, what exactly constitutes a qualified trade or business is not well defined by tax law. There are a number of different interpretations for different purposes of the tax code. Typically, to qualify as a business, the activity must be regular continuous and substantial.

![b2[1]](https://access.ultrasavvyphotographer.com/wp-content/uploads/2017/04/b21.png)